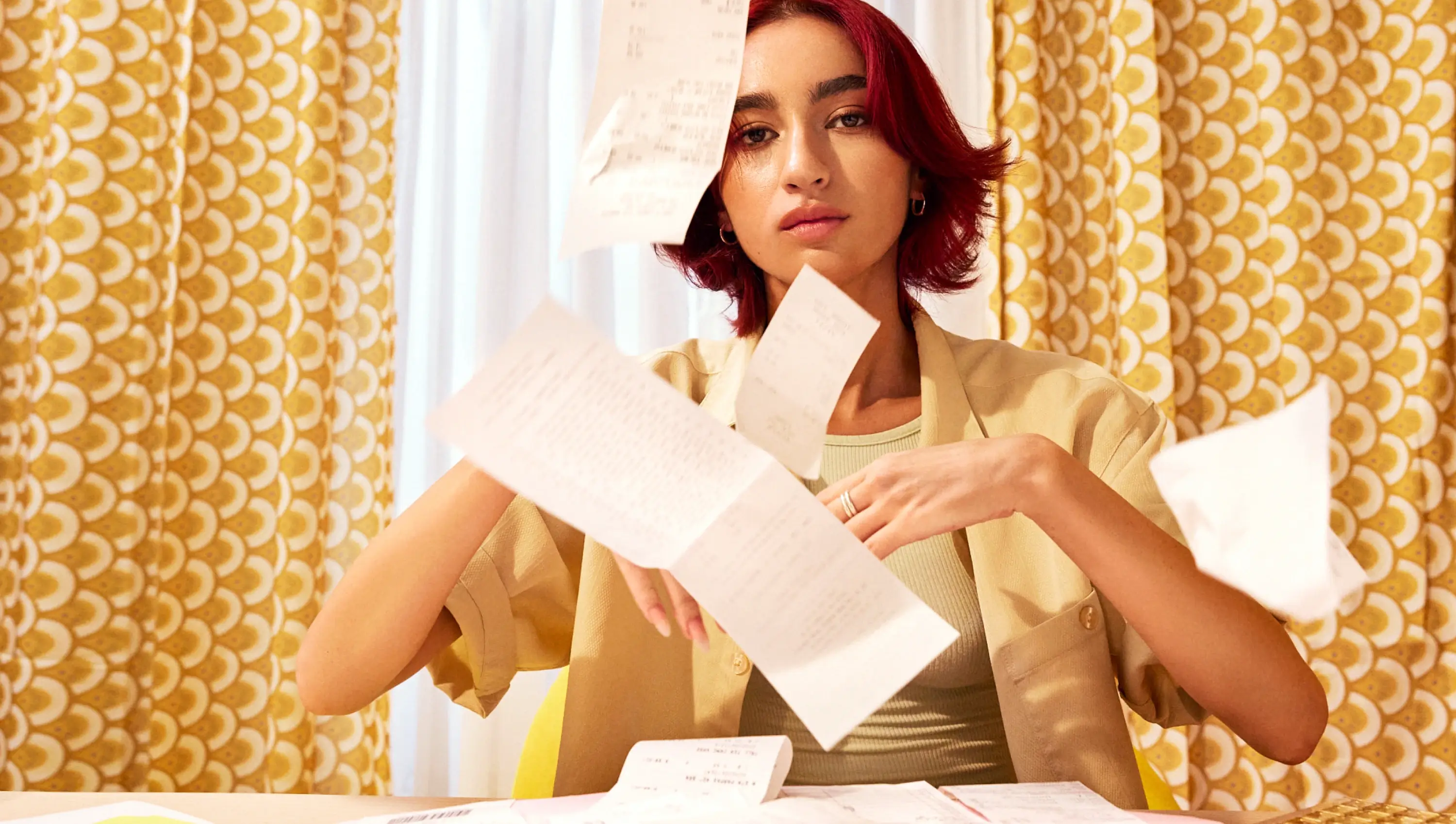

What is expense tracking and why is it important for freelancers?

Expense tracking is the process of keeping track of all the money you spend on your business as a freelancer. This includes everything from office supplies to travel expenses to software subscriptions. It is important for freelancers to track their expenses because it helps them to understand their business finances better, make informed decisions about spending, and prepare accurate tax returns.

What are some tools or methods for tracking expenses as a freelancer?

There are several tools and methods that freelancers can use to track their expenses. One popular method is to keep all receipts and invoices organized in a physical or digital folder. Another option is to use expense tracking software, such as QuickBooks or FreshBooks, which can automate the process and provide detailed reports. Some freelancers also use spreadsheets or mobile apps to track their expenses.

What expenses can freelancers deduct on their taxes?

Freelancers can deduct many business-related expenses on their taxes, including office supplies, travel expenses, software subscriptions, and professional development courses. However, it is important to keep accurate records and only deduct expenses that are necessary and directly related to your business. It is recommended to consult with a tax professional to ensure that you are deducting expenses correctly.

How often should freelancers track their expenses?

Freelancers should track their expenses regularly, ideally on a weekly or monthly basis. This helps to ensure that all expenses are recorded accurately and that there are no surprises when it comes time to file taxes. It also allows freelancers to monitor their spending and make adjustments as needed to stay within their budget.