What are business expenses?

Business expenses are costs incurred by a business in order to generate revenue. These expenses can include things like rent, utilities, salaries, and office supplies. Essentially, any cost that is necessary to keep the business running and producing goods or services can be considered a business expense.

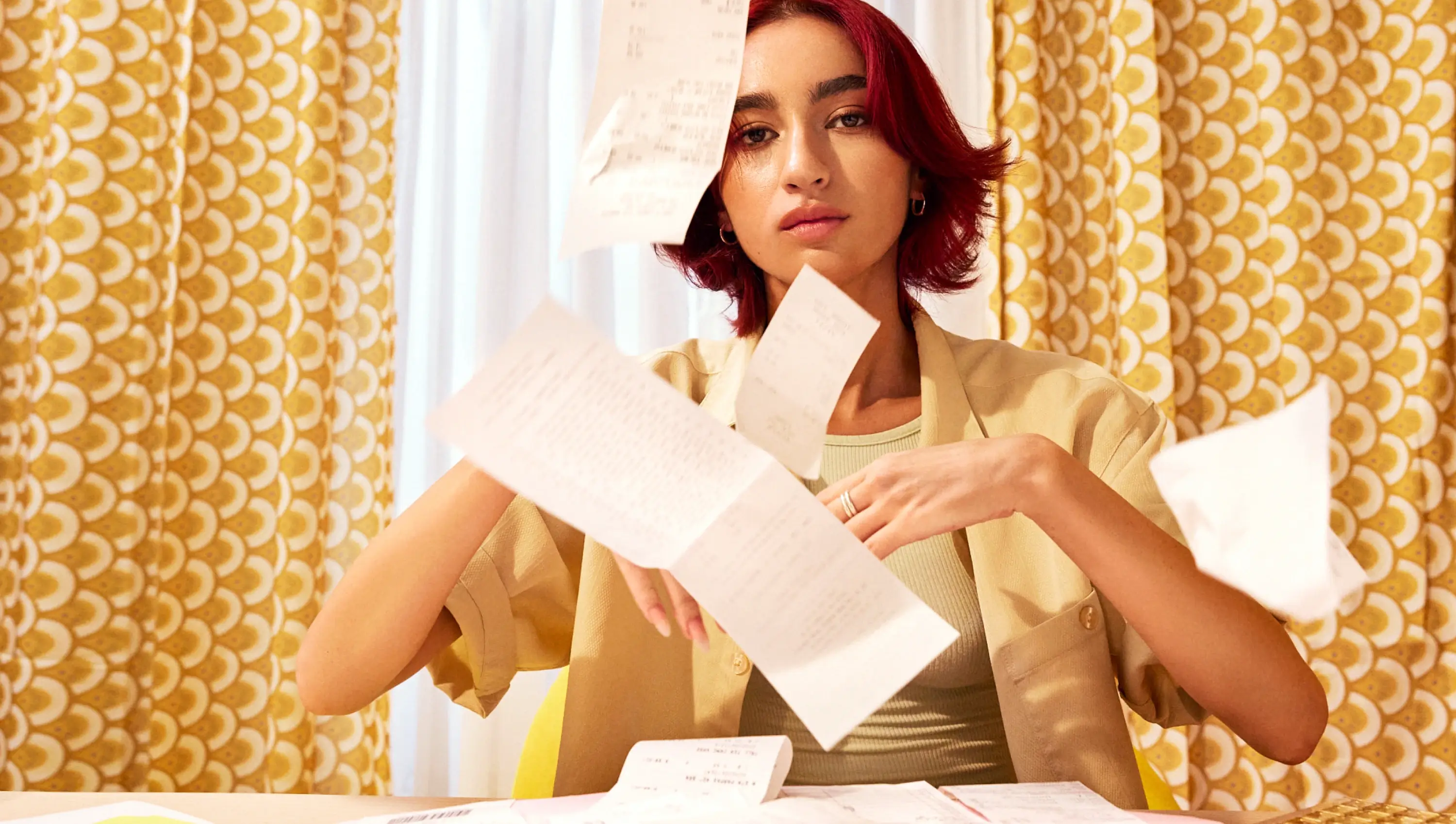

It's important to keep track of these expenses for tax purposes, as they can often be deducted from the business's taxable income. This can help to reduce the amount of taxes owed by the business.

What types of business expenses can be deducted on taxes?

There are many types of business expenses that can be deducted on taxes, including:

- Office rent and utilities

- Salaries and wages paid to employees

- Cost of goods sold (for businesses that sell products)

- Business travel expenses

- Advertising and marketing expenses

- Professional fees (such as legal or accounting fees)

- Insurance premiums

- Office supplies and equipment

It's important to keep accurate records of these expenses in order to claim them on taxes. It's also a good idea to consult with a tax professional to ensure that all eligible expenses are being claimed.

Can personal expenses be deducted as business expenses?

No, personal expenses cannot be deducted as business expenses. It's important to keep personal and business expenses separate in order to accurately track and claim eligible business expenses. Mixing personal and business expenses can also raise red flags with the IRS and potentially lead to an audit.

How can a business reduce its expenses?

There are many ways that a business can reduce its expenses, including:

- Negotiating better rates with suppliers

- Reducing energy usage and utility costs

- Implementing cost-saving measures, such as using energy-efficient equipment or reducing waste

- Outsourcing certain tasks to reduce labor costs

- Implementing technology solutions to streamline processes and reduce manual labor

- Offering flexible work arrangements to reduce office space and overhead costs

It's important to regularly review expenses and look for ways to reduce costs without sacrificing quality or productivity.